Course Library

We're sorry, but we couldn't find any results that match your search criteria. Please try again with different keywords or filters.

Loading

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Effectively navigating the IRS Collection Information Statement (CIS) process is crucial for securing hardship relief, Partial Payment Installment Agreements (PPIA), or affordable installment plans.Th ...Delivery Method:

- QAS Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 5 - 8 credits

Description:

This class will discuss the collection methods the IRS is using in the new enforcement environment. When clients are faced with IRS enforcement, representatives need a wide array of skills to protect ...Program Level:

BasicDelivery Method:

- Group Live

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Although, the IRS suspended the automatic mailing of collection notices routinely sent when a taxpayer owes federal tax on February 5, 2022 to give the IRS an opportunity to clear its processing backl ...Program Level:

OverviewDelivery Method:

- QAS Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Although, as reported in the National Taxpayer Advocate blog, the IRS suspended the automatic mailing of collection notices routinely sent when a taxpayer owes federal tax on February 5, 2022 to give ...Program Level:

OverviewDelivery Method:

- QAS Self Study

-

Field of Study:

- Taxes

Description:

Although the IRS suspended the automatic mailing of collection notices routinely sent when a taxpayer owes federal tax on February 5, 2022 to give the IRS an opportunity to clear its processing backlo ...Program Level:

OverviewDelivery Method:

- QAS Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

This course addresses the taxpayer’s rights when dealing with the IRS’s enforcement of tax collection. It outlines the various tax collection methods, billing processes, payment arrangements, statute ...Program Level:

BasicDelivery Method:

- QAS Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Staying ahead of IRS updates is crucial for effectively managing client cases, but with constant changes, how do you keep up? In this course, we explore the latest IRS compliance trends and uncover wh ...Delivery Method:

- QAS Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Staying ahead of IRS updates is crucial for effectively managing client cases, but with constant changes, how do you keep up? In this course, we explore the latest IRS compliance trends and uncover wh ...Delivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Most taxpayers file tax returns and pay what they owe on time. If a taxpayer does not pay, the Internal Revenue Service sends the taxpayer a bill. This begins the collection process.Facing IRS collect ...Delivery Method:

- QAS Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

The IRS has intensified its enforcement efforts targeting high-income taxpayers, increasing audits and compliance initiatives. High-net-worth individuals and businesses must now navigate an evolving t ...Delivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

The IRS Criminal Investigation (CI) division investigates crimes involving tax fraud, narcotics trafficking, money laundering, public corruption, healthcare fraud, identity theft, and more. This cours ...Program Level:

BasicDelivery Method:

- QAS Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

There is nothing wrong with sheltering tax through legal tax shelters. But over time, abusive tax shelters have evolved from simple transactions into very sophisticated strategies, now often bordering ...Delivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Navigating the complexities of IRS delinquent return investigations is critical for tax professionals aiming to guide their clients through the often-daunting compliance process. This CE Course will e ...Delivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Navigating the complexities of IRS delinquent return investigations is critical for tax professionals aiming to guide their clients through the often-daunting compliance process. This CE Course will e ...Delivery Method:

- QAS Self Study

-

Field of Study:

- Regulatory Ethics

Credit Hours:

- 1 - 4 credits

Description:

As a practitioner, it's crucial to understand the ethical obligations of IRS employees and the guidelines set by the Office of Government Ethics (OGE) Standards of Ethical Conduct. Join our CPE webina ...Delivery Method:

- QAS Self Study

-

Field of Study:

- Behavioral Ethics

- Regulatory Ethics

Credit Hours:

- 1 - 4 credits

Description:

Download price: $25. Print price: $35. (18% off if you order three or more courses). This course was updated on 4/12/2012. This course is designed to meet the Internal Revenue Service ethics requireme ... -

Field of Study:

- Regulatory Ethics

Credit Hours:

- 1 - 4 credits

Description:

This course covers information included in Treasury Department Circular No. 230 and offers ethics education for Enrolled Agents, CPAs and unenrolled tax preparers. This course covers ethics rules and ...Program Level:

IntermediateDelivery Method:

- QAS Self Study

-

Field of Study:

- Regulatory Ethics

Credit Hours:

- 1 - 4 credits

Description:

This course covers information included in Treasury Department Circular No. 230 and offers ethics education for Enrolled Agents, CPAs and unenrolled tax preparers. This course covers ethics rules and ...Program Level:

IntermediateDelivery Method:

- QAS Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

The IRS will most likely require you to file an information return, if you have made a payment during the calendar year as a self-employed individual or while operating as a small business. As your in ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

-

IRS Form 1099 in 2024: W-9, Backup Withholding and the New De Minimis Error Rules

22-Jan-2024 ClatidField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

IRS Form 1099 Due Diligence in 2024 Join us to learn the latest updates for Form 1099-MISC, specific reporting requirements for various types of payments and payees, filing requirements, withholding r ...Program Level:

BasicDelivery Method:

- Group Internet Based

-

IRS Form 1099 Reporting Requirements & Withholding - IRS Forms 1099-NEC and 1099-MISC Updates

13-Jan-2023 ClatidField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

As more and more small businesses are using independent contractors, the need to file 1099s is increasing. The IRS brought back Form 1099-NEC for 2021. This webinar will help participants know when th ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

As the digital asset landscape continues to evolve, tax and accounting professionals face new challenges in ensuring compliance with IRS regulations. The introduction of Form 1099-DA marks a significa ...Delivery Method:

- QAS Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

As the digital asset landscape continues to evolve, tax and accounting professionals face new challenges in ensuring compliance with IRS regulations. The introduction of Form 1099-DA marks a significa ...Delivery Method:

- Group Internet Based

-

Field of Study:

- Accounting

Credit Hours:

- 1 - 4 credits

Description:

Form 1099-K is used to report certain payment transactions including payments by payment cards (credit, debit, or stored value cards) and payments in settlement of third-party network transactions or ...Program Level:

INTERMEDIATEDelivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Form 1099 reporting has always been tricky, and changes in 2020 and 2021 continue to increase the reporting burden. Tucked away in the American Rescue Plan was a change to reporting on a form called a ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Are you up-to-date with the latest shifts in unemployment taxes? Join us for an enlightening webinar titled "IRS Form 940 and Unemployment," aimed at unraveling the intricate modifications in federal ...Delivery Method:

- QAS Self Study

-

Field of Study:

- Accounting

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

The IRS collects hundreds of billions of dollars of employment taxes each year – more than any other source of revenue. Form 941 and other related forms lie at the heart of the IRS’s employment tax co ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

In this practical webinar, you’ll receive step-by-step guidance on Form 941 and other related forms that lie at the heart of the IRS’s employment tax collection system. You’ll learn how to navigate em ...Program Level:

BeginnerDelivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

In this practical webinar, youll receive step-by-step guidance on Form 941 and other related forms that lie at the heart of the IRSs employment tax collection system. Youll learn how to navigate em ...Delivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

In this practical webinar, you will learn how to complete Form 990 – Part VI. Upon course completion, you will be able to describe: The IRS’s view on good governance “best practices” What policies a t ...Program Level:

BeginnerDelivery Method:

- Group Internet Based

Location:

- VA

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

In this webinar, you’ll learn how to correctly complete IRS Forms 941, 940 and W-2 and avoid IRS notices. You’ll also learn how to manage an IRS dispute and receive a brief overview of the new ACA for ...Program Level:

BeginnerDelivery Method:

- Group Internet Based

Location:

- VA

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Did you know that thousands of POA forms, including Forms 8821 and 2848, are rejected every year due to common mistakes? These errors can slow down critical processes for your clients and cost valuabl ...Delivery Method:

- Group Internet Based

-

IRS Forms W-8BEN and W-9 Compliance After Tax Reform: New Information Requirements and ECI Rules

24-Jul-2019 Barbri, Inc.Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Delivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- less than 1

Description:

Are you prepared for the increasing cybersecurity threats targeting taxpayers and practitioners during the holiday season? As online shopping surges, so does the risk of scams designed to steal person ...Delivery Method:

- Nano Learning

-

IRS Installment Agreements - How to Effectively Set Up A Payment Arrangement with the IRS

24-Feb-2023 ClatidField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Tax debt is nothing to brush off, especially when you owe an outrageous amount. If you can’t afford your tax debt, the IRS must decide if – and how – you’ll be able to pay. There are many different ty ...Program Level:

BasicDelivery Method:

- Group Internet Based

-

Field of Study:

- Accounting

Credit Hours:

- 1 - 4 credits

Description:

In this webinar, youll receive step-by-step guidance on the Internet resources and services offered by the IRS. Youll learn about the little-known IRS tools and applications that are available onlin ...Delivery Method:

- Group Internet Based

-

Field of Study:

- Information Technology

Credit Hours:

- 1 - 4 credits

Description:

Are you ready to unlock the full potential of the IRS online services? Join our CPE webinar and explore the hidden gems of the IRS digital world. In this course, you'll discover dozens of valuable IRS ...Delivery Method:

- QAS Self Study

-

Field of Study:

- Taxes

Credit Hours:

- less than 1

Description:

For the first time in years, the IRS has issued lower auto depreciation limits, which will significantly affect businesses that rely on vehicle deductions. This CE nano-learning course by Eric Knight ...Delivery Method:

- Nano Learning

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Employee Retention Credit (ERC) Claims In mid-September, the IRS announced a moratorium on processing new employee retention credit (ERC) claims through at least December 31, 2023. Tax professionals a ...Program Level:

BasicDelivery Method:

- Group Internet Based

-

IRS Notice 2022-6 Sharply Hikes Distributions From Qualified Plans Pre-59½, Robert Keebler's February Webinar

17-Feb-2022 Advisors4AdvisorsField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

One of the most important financial planning stories of 2022: New rules in IRS Notice 2022-6 just sharply hiked distributions amounts permitted from qualified plans before age 59½. The new rules wil ...Program Level:

OverviewDelivery Method:

- Group Internet Based

Location:

- NY

-

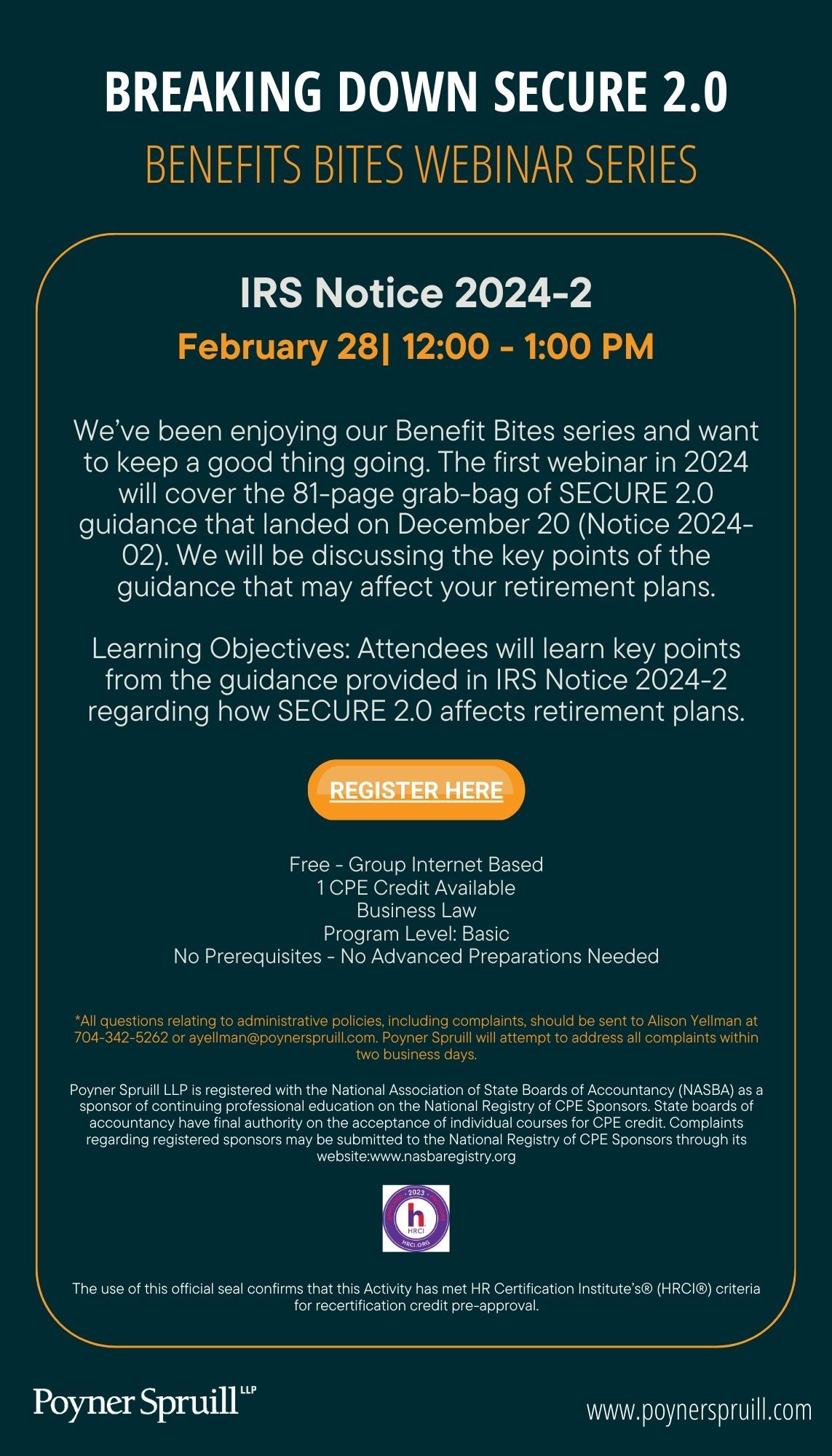

Field of Study:

- Business Law

Credit Hours:

- 1 - 4 credits

Description:

We’ve been enjoying our Benefit Bites series and want to keep a good thing going. The first webinar in 2024 will cover the 81-page grab-bag of SECURE 2.0 guidance that landed on December 20 (Notice 20 ...Program Level:

BasicDelivery Method:

- Group Internet Based

Location:

- NC

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Part 3 of a comprehensive 3-part series intended to help you understand and become savvy with the IRS Offer in Compromise program. This course goes in depth with a case study that shows five different ...Delivery Method:

- Group Internet Based

- QAS Self Study

Location:

- UT

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Part 1 of a comprehensive 3-part series intended to help you understand and become savvy with the IRS Offer in Compromise program. This course provides a rapid fire overview of the Offer In Compromise ...Delivery Method:

- Group Internet Based

- QAS Self Study

Location:

- UT

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Part 2 of a comprehensive 3-part series intended to help you understand and become savvy with the IRS Offer in Compromise program. This course goes in depth with more considerations when weighing the ...Delivery Method:

- Group Internet Based

- QAS Self Study

Location:

- UT

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

An offer in compromise is an agreement between a taxpayer and the IRS that settles the tax debt owed for a set price. There are two types of offer I'm compromises that will be covered in this presenta ...Program Level:

BasicDelivery Method:

- Group Internet Based

-

IRS Offshore Voluntary Disclosures: What’s Next In Disclosing Offshore Accounts LIVE Webcast

10-Jun-2016 The Knowledge Group, LLCField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

This Program will outline and cover: The IRS Voluntary Disclosure Programs of the past The current IRS Voluntary Disclosure Programs The changes that have recently taken place in the current IRS Volun ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

Location:

- NJ

-

IRS on Earned Income Credit and Child Tax Credit: Claiming the Dependents in 2023

10-Mar-2023 ClatidField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Join us this March to learn about a foundational aspect of individual tax returns - claiming dependents. Tax law lays out two types of dependents – qualifying children and qualifying relatives. The ru ...Program Level:

BasicDelivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

This course is Part 2 of a comprehensive 2-part series intended to help you understand and become savvy with the IRS Penalty Abatement program. The IRS assesses millions of dollars of penalties agains ...Program Level:

AdvancedDelivery Method:

- Group Internet Based

- QAS Self Study

Location:

- UT

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

This course is Part 2 of a comprehensive 2-part series intended to help you understand and become savvy with the IRS Penalty Abatement program. The IRS assesses millions of dollars of penalties agains ...Delivery Method:

- Group Internet Based

- QAS Self Study

Location:

- UT

-

IRS Penalty Abatement Basics - Common Penalties, FTA Instructions, and Reasonable Cause Considerations

09-Nov-2017 Canopy TaxField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

This course is Part 1 of a comprehensive 2-part series intended to help you understand and become savvy with the IRS Penalty Abatement program. The IRS assesses millions of dollars of penalties agains ...Delivery Method:

- Group Internet Based

- QAS Self Study

Location:

- UT

27255 Results