National Registry Summit – Speaker Spotlight: CPA Evolution Update - Dan Dustin, CPA

Dan Dustin, CPA, Vice President, State Board Relations, NASBA, began his Registry Summit - CPA Evolution Update by explaining that while we have been focusing on the students and candidates, and getting them into the pipeline, it is equally as important to talk about upskilling those in the profession.

According to the National Student Clearinghouse, between 2019-2021, undergraduate enrollment fell 6.6%, the largest two-year decrease in more than 50 years, and there was a 13% drop in Community College enrollment. This was a great loss to the profession and other occupations. Now, we hope to see the trend change in the coming years. The good news is that some state boards are reporting that the number of professionals seeking licensure has not significantly declined. Dustin said it will be interesting to see in the next six months to a year what happens with the economy and the pipeline as oftentimes the accountancy pipeline tends to thrive during economic downturns.

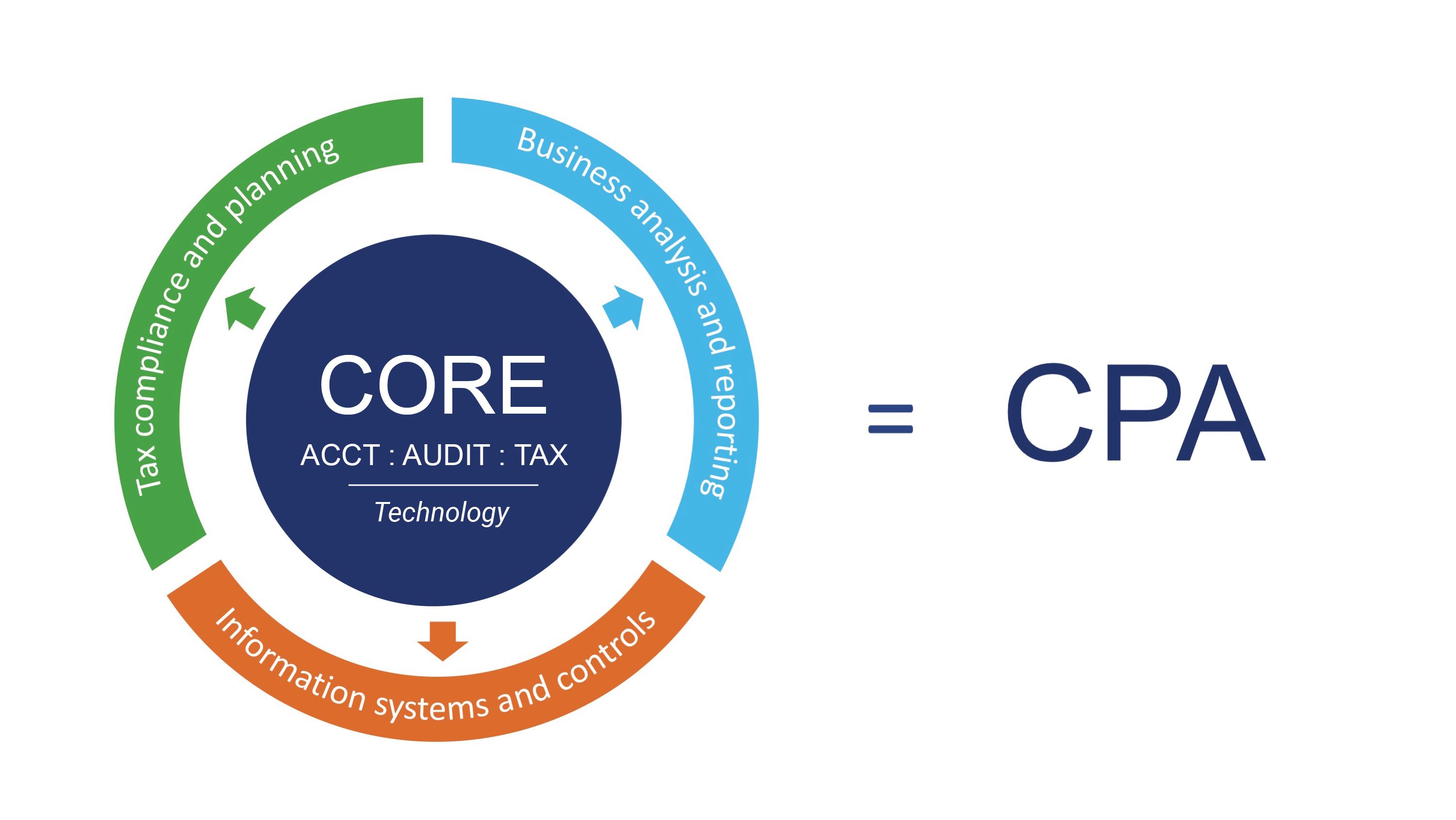

With regard to upskilling those already in the profession, firms that were surveyed as to what they are looking for from new hires mentioned data analysis, cybersecurity and digital acumen as important skill sets. Dustin shared a slide that compared CPA firm accounting vs. non-accounting hires between 2010-2020. What the audience saw was that over time, firms have been hiring non-accounting program graduates because they were looking for skills and competencies that were not being developed through accounting programs. Dustin explained that we want to now change that trend and mindset with CPA Evolution which will provide both a new curriculum and a new CPA examination. The CPA Evolution Model Curriculum was released in June 2021 and the new CPA Exam is scheduled to launch in 2024. The new examination consists of three core sections: Auditing and Attestation, Financial Accounting and Reporting and Taxation and Regulation, as well as three additional sections: Information Systems and Controls, Business Analysis and Reporting, and Tax Compliance and Planning. Candidates will take all three of the core sections and select a fourth section from the three newly created sections.

With regard to upskilling those already in the profession, firms that were surveyed as to what they are looking for from new hires mentioned data analysis, cybersecurity and digital acumen as important skill sets. Dustin shared a slide that compared CPA firm accounting vs. non-accounting hires between 2010-2020. What the audience saw was that over time, firms have been hiring non-accounting program graduates because they were looking for skills and competencies that were not being developed through accounting programs. Dustin explained that we want to now change that trend and mindset with CPA Evolution which will provide both a new curriculum and a new CPA examination. The CPA Evolution Model Curriculum was released in June 2021 and the new CPA Exam is scheduled to launch in 2024. The new examination consists of three core sections: Auditing and Attestation, Financial Accounting and Reporting and Taxation and Regulation, as well as three additional sections: Information Systems and Controls, Business Analysis and Reporting, and Tax Compliance and Planning. Candidates will take all three of the core sections and select a fourth section from the three newly created sections.

)

)